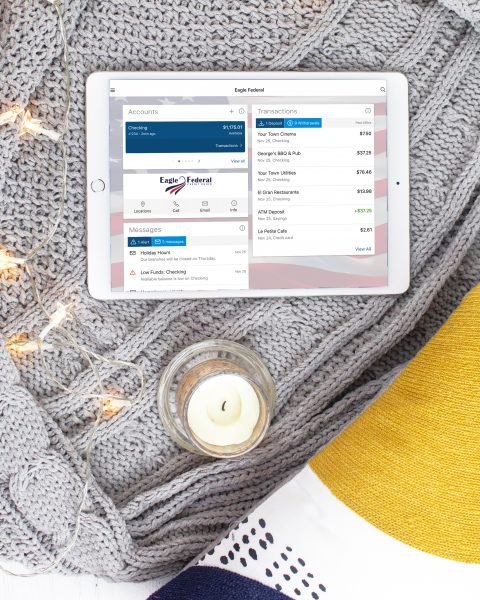

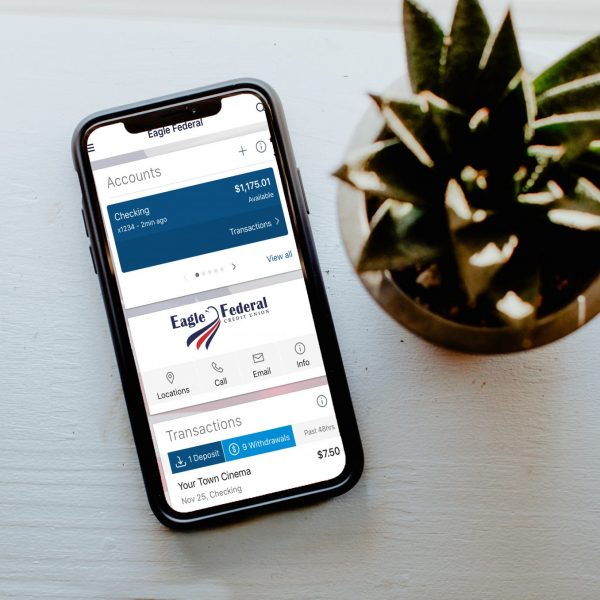

Mobile Banking for convenient on-the-go access to your Eagle Federal accounts.

Stay connected with Mobile Banking. Manage your accounts any time from anywhere with your mobile device.

- Downloadable App – Free app for your smart phone or tablet

- Set up SMS text alerts

- Check account balances

- View transaction history

- Make quick one-time transfers

- Schedule one-time bill and recurring payments

- Zelle® lets you send money with just a few taps on your mobile phone.

- Control Your Card online or in the mobile app

Download the App

Deposit checks with your Mobile Device!

Deposit checks anywhere, anytime using your smart phone or tablet. Mobile Deposit is a convenient, easy, and secure way to deposit checks. Sign your check, enter the amount, snap a picture for the front and back of the check and submit!

Mobile Deposit FAQs

-

What is Mobile Deposit service?

With Mobile Deposit, you can make a deposit directly into an eligible checking or savings account using the Mobile Banking app on supported Apple and Android devices. Mobile Deposit lets you submit photos of the front and back of an endorsed check. It allows you to safely deposit checks without having to visit a branch.

-

Who is eligible to use Mobile Deposit?

You are eligible if you have an active Savings and/or Checking account with Eagle that is in good standing. You must also accept the Mobile Deposit Terms and Conditions (pdf) during enrollment. Eagle reserves the right to remove access to Mobile Deposit at any time.

-

Do I need an email address?

Yes. Mobile Deposit is an electronic service and requires a valid email address. The email address must be the same used in Online Banking. All notifications regarding Mobile Deposit will be sent to this email address. An invalid email address may cause this service to be disabled.

-

How do I enroll in Mobile Deposit?

You may self-enroll from the Mobile Banking App. You must first have Online Banking access and download the Mobile Banking app, then follow the these steps:

-

- Log into Mobile Banking and select ‘Deposits’ option in the menu.

- Complete the ‘User Registration’ page by inputting – First Name, Last Name, and confirm Email; then select ‘Continue’.

- Select the accounts to be used with ‘Mobile Deposit’ and select ‘Done’.

- Accept the ‘Terms and Conditions’ by selecting the ‘I Agree’ box and select ‘Continue’.

- You are now ready to make a deposit.

-

-

How do I make a deposit?

Once you have enrolled you are ready to begin

- Log into Mobile Banking and select ‘Deposits’ option in the menu.

- Select ‘Deposit a Check’ from the deposits menu.

- Select the ‘Check Front’ camera button; your camera will engage for you to take a picture of the front of the check. If the picture is good, select use.

- Select the ‘Check Back’ camera button; your camera will engage for you to take a picture of the back of the check. If the picture is good, select use.

- Input the amount of the check.

- Select the account you wish to deposit your funds to from the drop down box.

- Select ‘Deposit’ – you will receive a confirmation screen.

- Select OK and your deposit is complete (an email confirmation will also be sent to the email address).

-

What types of checks can I deposit?

Checks payable in US dollars and drawn at any US Bank, including personal, business, and government checks are acceptable. The checks must also be payable to you as the account holder and endorsed by you. Checks payable to two parties will only be accepted if both parties are owners of the deposit account and both parties have endorsed the check. The following checks are not eligible for Mobile Deposit: International checks, US Savings Bonds, Money Orders, remotely created checks, convenience checks, cashier’s checks, and cash.

-

When will my deposit be available?

Deposited terms will have a 3 business day hold when deposited. Holds may be extended based on large deposit amount, frequent overdrafts, deposited check returned unpaid, or indications a deposited check may not be paid. If a hold is extended an email will be sent to you at the email address on file for Mobile Deposit. Your available balance and hold release date will show in transaction history in ‘Mobile Banking’. (It may take up to 5 minutes for a pending deposit to be reflected in transaction history.)

-

What is the limit on how much money I can deposit through Mobile Deposit?

The following limits apply:

- Only one check may be deposited per transaction

- No more than 3 deposits per day

- Daily transaction totals not to exceed $5,000

- No more than 10 deposits per month

- No more than $10,000 per month

-Limits have been temporarily increased due to COVID-19.

-

How can I find my limits?

You can find your limits by selecting the information icon on the Deposit a Check screen. The Deposit Limits screen will display your limits and how much of the limit you have used.

-

How will I know if there is a problem with my deposit after it has been submitted?

Deposits will be reviewed by Eagle staff by close of business on the first business day after the date of deposit. If Eagle rejects the deposit for any reason, an email will be sent to you.

-

What should be done with the paper check after submission?

You should retain the original check for 60 days from the date of deposit. After 60 days you should void the check and destroy it.

-

Are there fees for using Mobile Deposit?

There is no cost to deposit checks through Mobile Deposit, but normal transaction fees still apply. You may incur NSF or Courtesy Pay fees if deposited funds are not available when withdrawals are presented for payment. You may incur a return deposit fee if the deposited item is returned unpaid for any reason.

-

What if I get an error when making a deposit?

Common errors include the following:

- Image Quality – retake the photo and resubmit deposit

- Can’t Detect Check – retake the photo and resubmit deposit

- Amount entered did not match the amount detected – re-enter the amount, retake the photo, and resubmit deposit

- Deposit limit has been exceeded – either daily or monthly limits have been exceeded. You will need to make your deposit at a branch, service center, or by mail.

- Cannot read account data on bottom of check – account information on bottom of check is not clear or inaccurate. Verify check is a valid check type to be accepted, retake photo and resubmit.